Mega Backdoor Roth Contribution Limit 2024

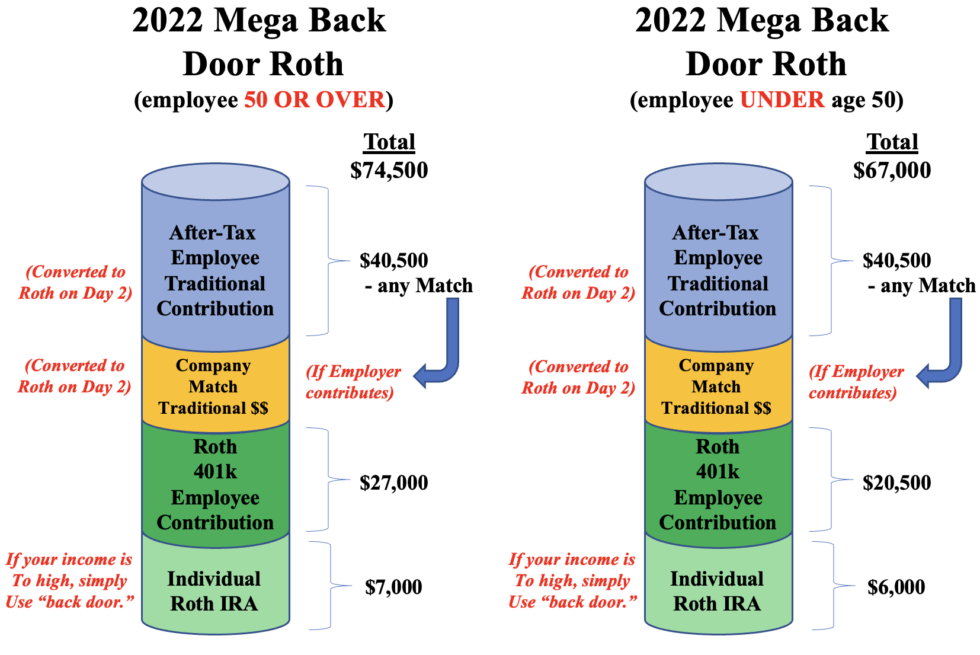

Mega Backdoor Roth Contribution Limit 2024. This includes the regular 401 (k). A mega backdoor roth allows you to contribute more than the typical limit to a roth 401 (k) or ira.

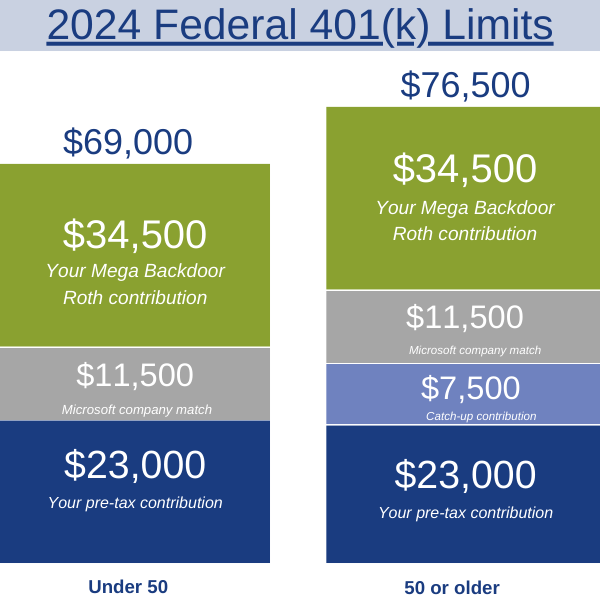

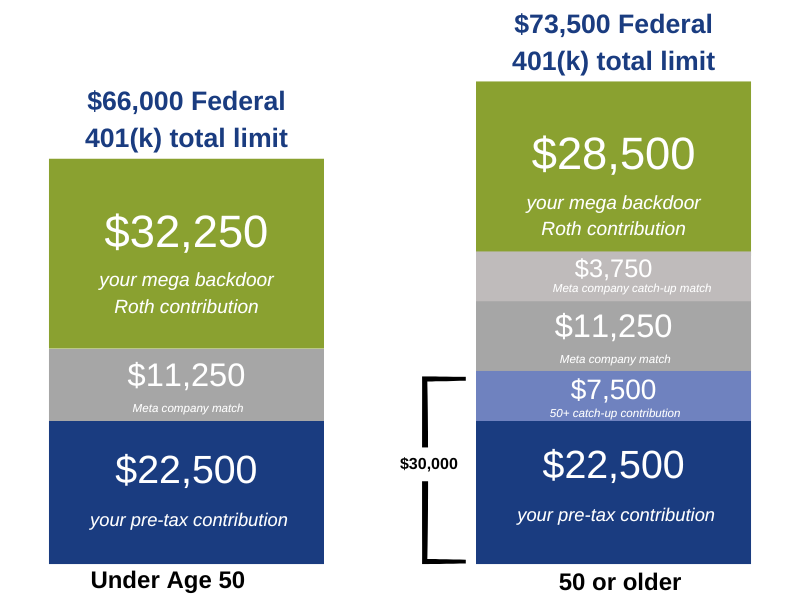

You’ll need to know the maximum. In 2024, a participant can contribute up to $23,000, which is up from $22,500 in 2023 ($30,500 and $30,000 for people 50 and over in 2024 and 2023, respectively) in pretax compensation and as.

Mega Backdoor Roth Contribution Limit 2024 Images References :

Source: drerodina.pages.dev

Source: drerodina.pages.dev

Backdoor Ira Contribution Limits 2024 Rivy Susana, What is the contribution limit for a mega backdoor roth?

Source: avieradvisors.com

Source: avieradvisors.com

Microsoft Mega Backdoor Roth Conversion Avier Wealth Advisors, This amount is on top of the standard 401 (k) contribution limit, which is.

Amazon Mega Backdoor Roth Sophos Wealth Management, In addition to your traditional or roth 401 (k) contributions (limit of $23,000 or $30,500 over age 50 for 2024), some 401 (k) plans allow you to contribute to a third.

Source: lauriqdarelle.pages.dev

Source: lauriqdarelle.pages.dev

Mega Backdoor Roth 2024 Limit Bessy Charita, The regular 401 (k) contribution for 2024 is $23,000 ($30,500 for those 50 and older).

Source: joyqdelcina.pages.dev

Source: joyqdelcina.pages.dev

Backdoor Roth Ira Limits 2024 Jenn Karlotta, The roth ira contribution limits in 2024 were raised to $7,000, or $8,000 for taxpayers 50 and older.

Source: angelinawrisa.pages.dev

Source: angelinawrisa.pages.dev

2024 Roth Ira Contribution Limits Chart Dayle Erminie, The mega backdoor roth limit for 2024 is expected to be $58,000 for individuals under the age of 50 and $64,500 for those 50 and older.

Source: seekingalpha.com

Source: seekingalpha.com

Mega Backdoor Roth Definition & How It Works Seeking Alpha, Here are the key details of her.

Source: rgwealth.com

Source: rgwealth.com

Mega Backdoor Roth Conversions Too Good to be True?, In 2024, the backdoor roth ira contribution limit is $7,000, or $8,000 for those over age 50.

Source: managingfi.com

Source: managingfi.com

Mega Backdoor Roth My Step by Step HowTo Guide Managing FI, Your 401 (k) contributions increased in 2024.

Source: avieradvisors.com

Source: avieradvisors.com

What is the Meta Mega Backdoor Roth? Avier Wealth Advisors, Both traditional and roth 401 (k)s allow a maximum employee contribution in 2024 of $23,000 annually.

Category: 2024